Eigenlayer Slashing upgrade: Key Features and Implications for YieldNest

EigenLayer deployed a significant protocol upgrade which introduced "Slashing" on April 17, 2025. This upgrade, detailed in EigenLayer Improvement Proposal-002 (ELIP-002), aimed to enhance security and accountability within the EigenLayer ecosystem by introducing mechanisms that allow Autonomous Verifiable Services (AVSs) to enforce cryptoeconomic commitments or, in other words, slashing.

Key Features of the Slashing Upgrade

- Slashing Capabilities: AVSs can penalize non-compliant or underperforming operator sets by slashing their staked assets, incentivizing reliable and honest behavior.

- Operator Sets: AVSs create operator groups which operators can join to secure their services. Operators in these groups earn rewards but also face slashing penalties based on the AVS's rules.

- Unique Stake Allocation: Operators can allocate a percentage of their stake to an operator set. This makes that amount slashable by the owning AVS but keeps the unallocated portion safe, though the unallocated stake won't earn rewards.

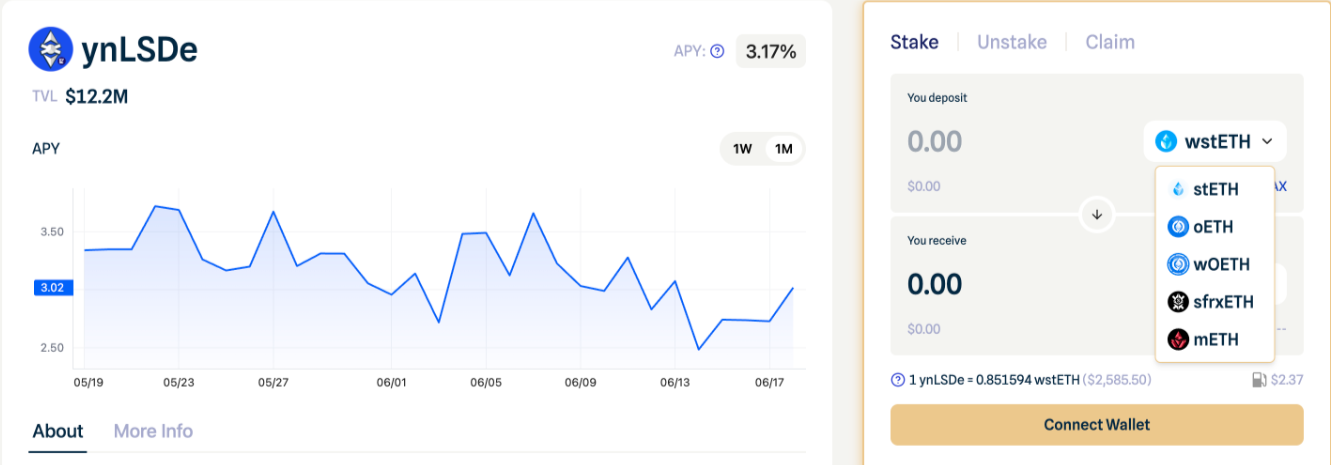

For YieldNest, a Liquid Restaking protocol and one of our customers, this upgrade introduced breaking changes and accounting issues stemming from previously unaccounted slashing events. YieldNest leveraged EigenLayer by offering liquid restaking solutions that enhance yield opportunities for Ethereum (ETH) holders via Liquid Restaking Tokens (ynLSDe) and native Liquid Restaking Tokens (ynETH). Detailed breakdown of both products below.

- ynETH: This native liquid staking token (nLRT) allows users to restake their ETH directly into EigenLayer, earning rewards from ETH validators and a curated basket of Actively Validated Services (AVSs). Users receive ynETH tokens, which are liquid and can be utilized across various decentralized finance (DeFi) platforms.

- ynLSDe: Designed for holders of Liquid Staking Tokens (LSTs) from platforms like Lido, Frax Finance, Mantle, and Origin Protocol, ynLSDe enables restaking into EigenLayer. This approach allows users to earn additional yields without unstaking their assets, maintaining liquidity while benefiting from multiple reward streams.

Slashing Upgrade Implications on YieldNest

The introduction of the Slashing Upgrade in EigenLayer presented new challenges for YieldNest’s restaking mechanisms, requiring updates to how balances and withdrawals are managed.

Changes to Balance Tracking

When users deposit tokens into ynETH or ynLSDe, new tokens are minted based on the total assets deposited into the platform, including those restaked in EigenLayer. Previously, YieldNest’s smart contracts accounted for these restaked assets directly as part of the platform’s balance. However, with the Slashing Upgrade, this approach had to be revised since restaked assets are now subject to potential slashing.

To address this, we updated balance tracking logic to only reflect withdrawable (non-slashed) assets, excluding any funds that have been slashed due to operator misbehavior. Our revised approach ensures that slashed assets are no longer included in reported balances, offering a more accurate and secure reflection of user holdings.

Impact on Withdrawals

Before the Slashing Upgrade, when a user initiated a withdrawal for x amount of shares, the system would process and complete the withdrawal for exactly x shares after the standard waiting period of up to 8 days. However, with the upgrade, queued withdrawals remain at risk of being slashed during this waiting period.

If slashing occurs after a withdrawal is queued, the final amount withdrawn may be y instead of x, as some of the originally requested shares may have been slashed in the interim.

To ensure an accurate balance and withdrawal process, we implemented a synchronization mechanism that updates the amount of queued shares every time a slashing event occurs. This means that the platform will continuously adjust the queued withdrawal amounts in real-time, ensuring that only the remaining non-slashed shares are accounted for in the balance and ultimately withdrawn.

By adapting to these new slashing mechanics, YieldNest ensures that users’ funds are accurately tracked, withdrawals remain fair, and the platform remains resilient in the evolving EigenLayer ecosystem.

The solution is available in the links below:

- https://github.com/yieldnest/yieldnest-protocol/pull/198 contains the new EigenLayer contracts.

- https://github.com/yieldnest/yieldnest-protocol/pull/214 contains ynLSDe changes.

- https://github.com/yieldnest/yieldnest-protocol/pull/220 contains ynETH changes (delivered by the YieldNest team).

BootNode

BootNode is a high-output engineering and product shop specializing in DeFi, staking, infrastructure, and interoperability. We help protocols and builders ship faster and scale smarter — from zero to mainnet and beyond. Explore other projects and get in touch here.

YieldNest

YieldNest is a next-generation liquid restaking protocol that simplifies decentralized finance (DeFi) by offering high-yield, risk-adjusted restaking and DeFi strategies. It consolidates various DeFi strategies into unified, high-powered assets with Layer 1 settlement assurances.

EigenLayer

EigenLayer is a decentralized protocol built on Ethereum that introduces the concept of "restaking," allowing ETH stakers to secure multiple protocols simultaneously. By restaking, users can delegate their staked ETH or Liquid Staking Tokens (LSTs) to various decentralized applications (dApps) and services, thereby extending Ethereum's security to these platforms without requiring additional capital. This mechanism enhances the security of emerging projects and enables stakers to earn additional rewards.